Islamic Banking In Malaysia 2020

Single counterparty exposure limit for islamic banking institutions.

Islamic banking in malaysia 2020. Kuala lumpur sept 25. Gold banking a game changer for islamic finance. Malaysia is home to a number of dedicated islamic banks. A bird s eye view of kuala lumpur july 8 2020.

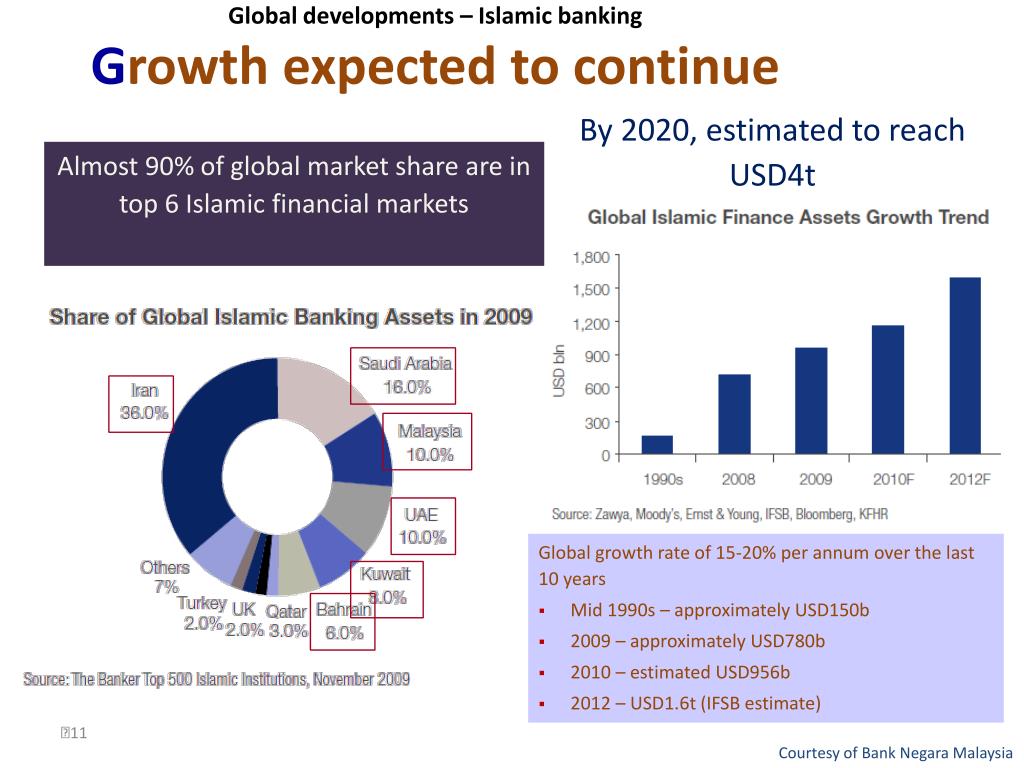

Malaysia can expect half of its banking assets to be islamic by 2030 as the industry s growth outpaces conventional banking according to a lenders association. 9 3 outpacing that of conventional banking s 3 3 underpinned by the banks. With the introduction of value based intermediation vbi by bank negara malaysia bnm in 2017 the association of islamic banking and financial institutions malaysia aibim is confident the central bank s target for the local islamic banking industry to have 40 market share in total banking assets by 2020 is achievable. Value based intermediation amid malaysia s islamic banking landscape as at the end of august 2020 financing by islamic financial institutions had risen 9 2 to rm655 6 billion us 157 68 billion end of august 2019.

Islamic finance our journey. Strategy paper on value based intermediation vbi value based intermediation. By 2016 that figure had leapt to 28 per cent and the malaysian government hopes to push it over 40 per cent by 2020. South africa s debut sukuk was very tough south african treasury.

As at end july 2020 mof said the domestic icm was valued at rm2 2 trillion accounting for 66 2 per cent of malaysia s rm3 3 trillion total capital market. Rm600 3 billion us 144 38 billion. Malaysia which pioneered islamic finance in the 1980s set a target for islamic banking assets to reach 40 of the total industry by 2020. While sukuk issuances account for rm130 8 billion or 60 2 per cent of total bond issuances.

Picture by hari anggara. In 2008 islamic banking accounted for 7 1 per cent of malaysia s financial sector. Staff training expenditure ste 30 jul 2020. The icm will also continue to thrive with malaysia being the world s largest issuer of sukuk and islamic equity it said.

Kuala lumpur oct 20 malaysia s islamic banking sector registered a capital adequacy ratio of 17 7 per cent in fourth quarter q4 2019 the highest for the year according to the islamic financial services board ifsb.