Tax Incentives In Malaysia

Dated 7 july 2017 for tax incentives to promote the establishment of principal hubs in malaysia.

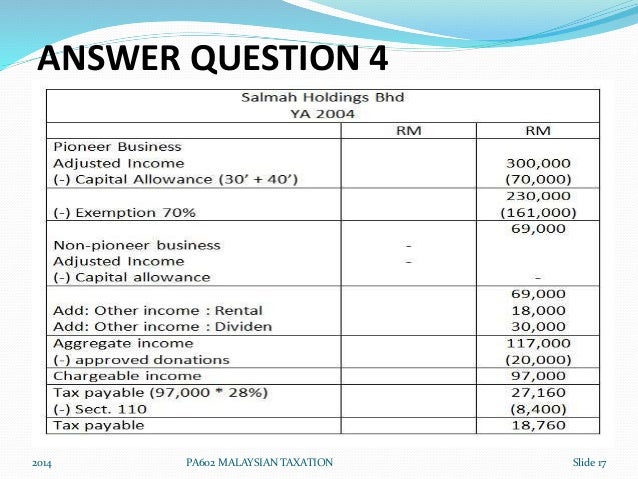

Tax incentives in malaysia. Tax incentives in malaysia. Msc malaysia status is awarded by the government of malaysia to eligible local and foreign ict related businesses. These acts cover investments in the manufacturing agriculture tourism including hotel and approved services sectors as well as r d training and environmental protection activities. The ita is set off against 70 of statutory income.

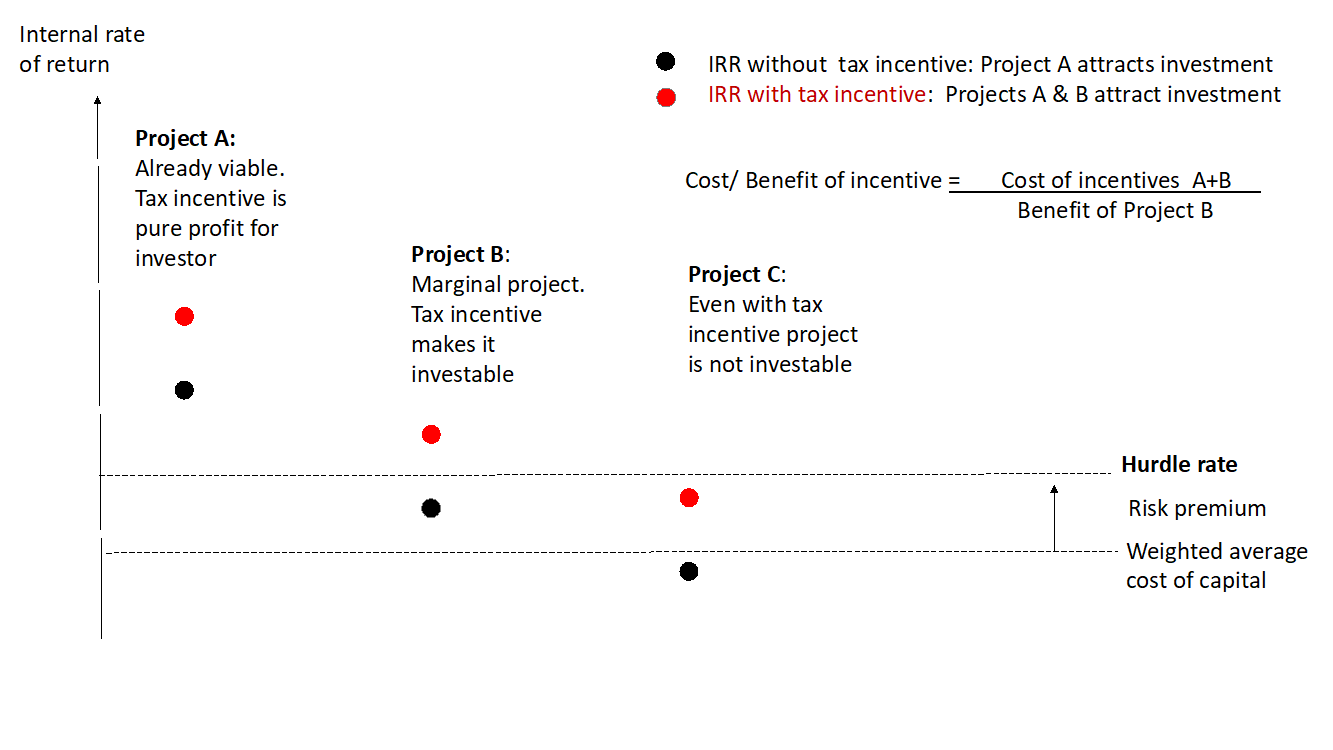

An increase in the individual personal income tax rate the highest band from 28 to 30 for individuals who are residents of malaysia having income of more than rm2 million approximately u s. Generally tax incentives are available for tax resident companies. The incentive available for such in house research is ita at 50 of qualifying capital expenditure incurred within 10 years. Extension of existing tax incentives for real estate investment trusts reits angel investors venture capital and certain insurance costs.

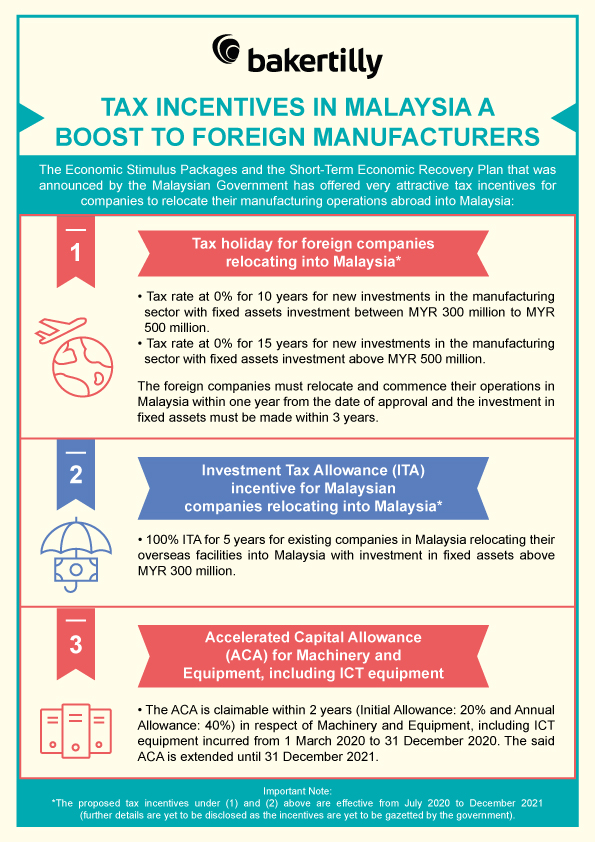

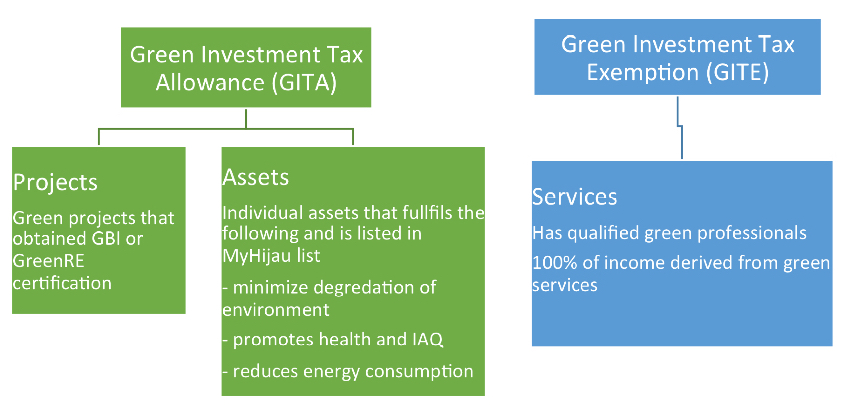

In malaysia tax incentives both direct and indirect are provided for in the promotion of investments act 1986 income tax act 1967 customs act 1967 excise act 1976 and free zones act 1990. Although the income is exempted from tax tax will have to be paid on the dividends paid on tax exempted income. In this article we will explain the main three types of tax incentives available for industries in malaysia which are pioneer status ps and investment tax allowance ita which are available under promotion of investment act 1986 and reinvestment allowance ra which is provided under income tax act 1967. There are different types of tax incentives offered in malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax deductions.

This is a good example of how the companies benefit. The alternative to pioneer status incentive is usually the investment tax allowance ita. Pioneer status ps is an incentive in the form of tax exemption which is granted to companies participating in promoted activities or producing promoted products for a period of 5 or 10 years. In the case of allowances there is a.

Carried on in malaysia within a company for the purpose of its own business. Companies undertaking biotechnology activity with approved bionexus status from malaysian biotechnology corporation sdn bhd will be eligible for the following incentives. 100 income tax exemption on statutory income for ten years from the first year in which the company derives statutory income or income tax exemption equivalent to a rate of 100 on qce incurred for a period of five years to be utilised against 100 of statutory income. In malaysia the corporate tax rate is now capped at 25.

Malaysia has enacted a number of tax incentives to encourage particular forms of economic activity. Malaysia offers a wide range of tax incentives ranging from tax exemptions allowances to enhanced tax deductions. A principal hub is a company incorporated in malaysia and that uses malaysia as a base for conducting its regional and global businesses and operations to manage control and support its key functions.