Public Mutual Prs Fund Withdrawal

Private retirement scheme prs contributors can now withdraw a maximum of rm1 500 from their account b.

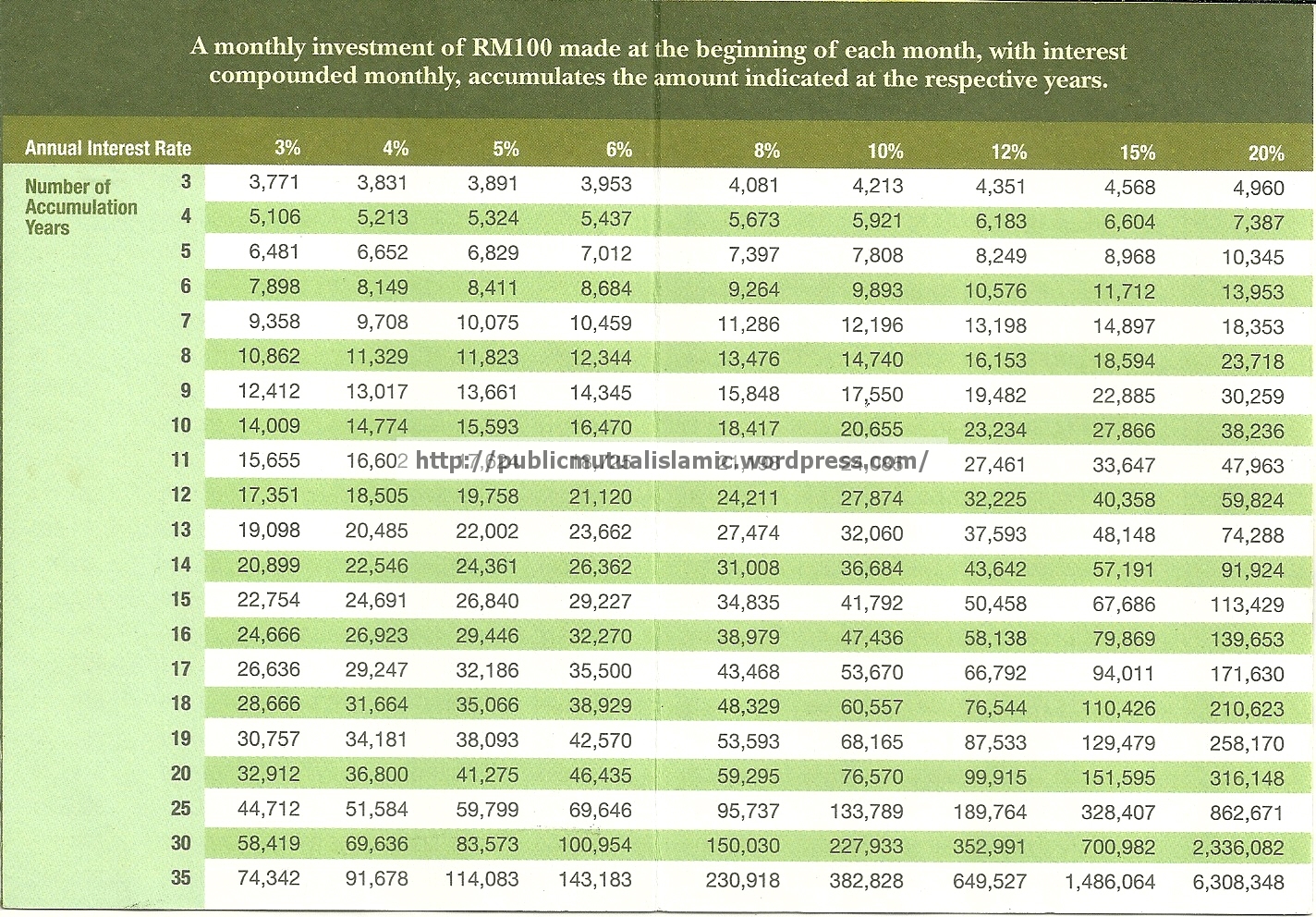

Public mutual prs fund withdrawal. Public mutual berhad a wholly owned subsidiary of public bank is a top private unit trust management company and leading prs provider in malaysia. You are able to make withdrawal for local or foreign treatments. The total investment is rm500k. Faq on prs pre retirement withdrawals that are exempted from tax penalty.

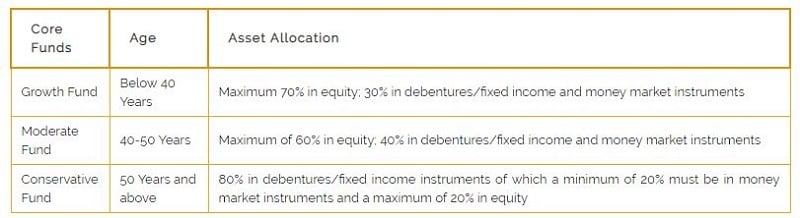

Similar to the epf system contributions are divided into two sub accounts which are divided 70 30 in sub account a and sub account b respectively. If an applicant applied for units in the funds and a supplementary prospectus or replacement prospectus is delivered to the securities commission for registration before the issuance or transfer of units to the applicant the applicant will be given the opportunity to withdraw his her application within 14 days from the date of his her receipt of notice of the registration of the supplementary. Public mutual bhd hotline. 603 2022 5000 email.

You can only withdraw funds from your prs account upon reaching retirement age currently 60 years or in the case of death or emigration. You will need to be either lucky. The fund invests in a. For more information on the forms and procedures please contact our customer service hotline at 03 2022 5000.

Definitely the prs fund whichever you choose would receive recurring income from managing your money whether or not you make any. Private retirement scheme prs is a voluntary long term contribution scheme designed to help individuals accumulate savings for retirement. Members may request for withdrawal from one or more funds managed by each prs provider to a maximum amount of rm1 500 per provider. The prs withdrawal form and supporting documents are to be submitted to any prs provider in which the prs member has an account with.

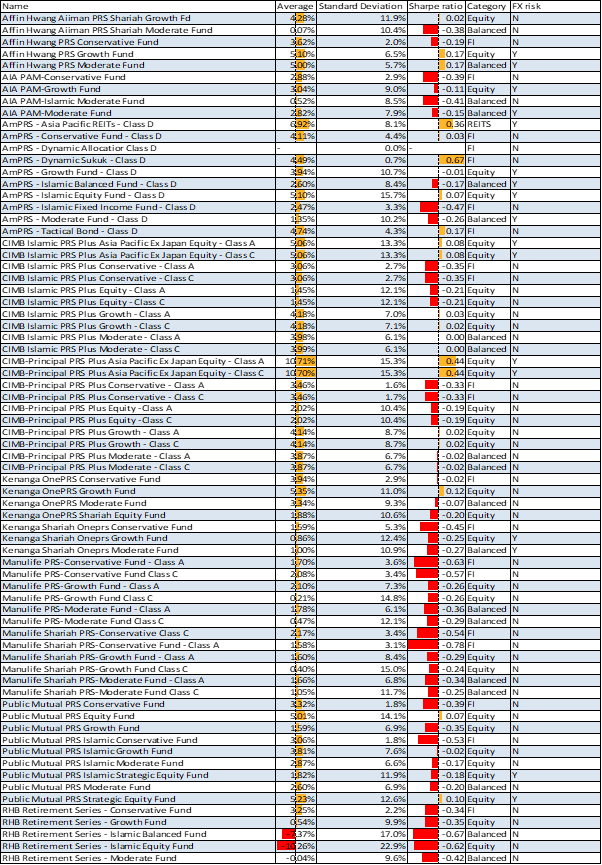

Public mutual prs conservative fund is an open end pension fund incorporated in malaysia. By the way not all the 56 funds are allowable for epf withdrawal. We offer a comprehensive range of products comprising conventional and shariah based unit trust and prs funds as well as financial planning services. Is the withdrawal for healthcare application restricted for only one prs fund at a time.

Is this withdrawal for healthcare restricted to only local treatment coverage. I invested public mutual from 2016 till feb 2020.