Income Tax Deduction Malaysia Calculator

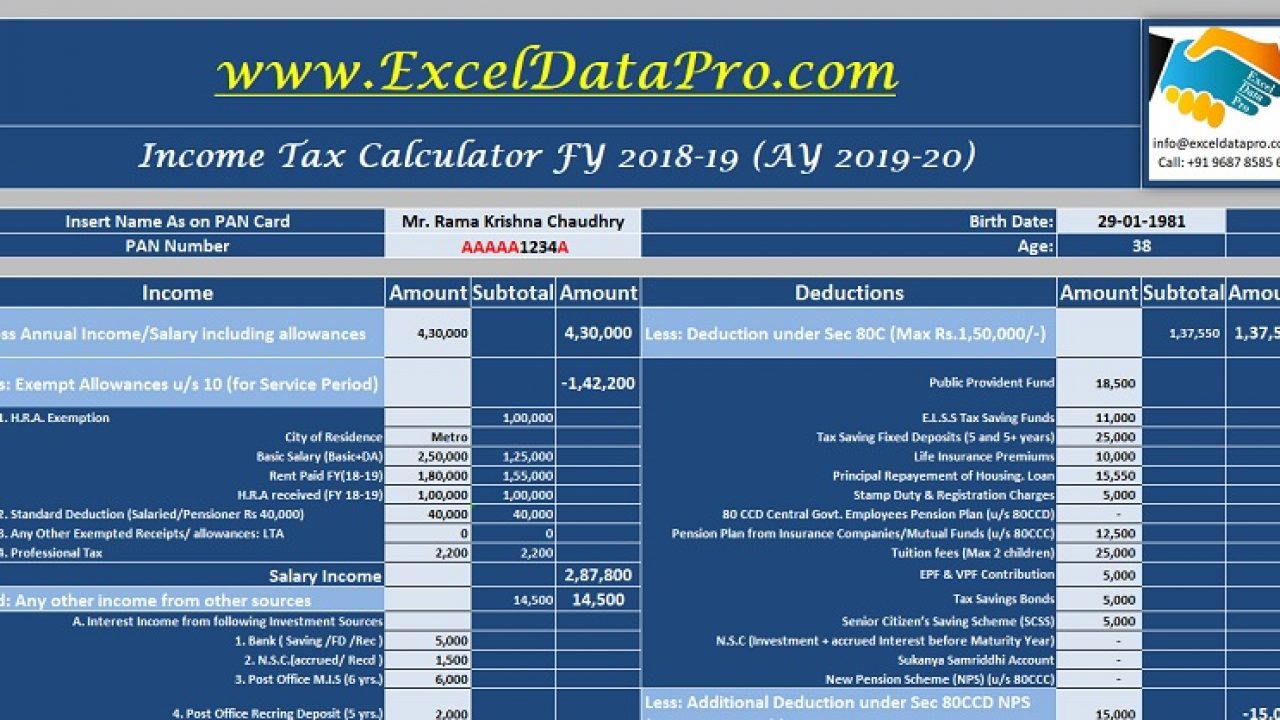

The annual wage calculator is updated with the latest income tax rates in malaysia for 2019 and is a great calculator for working out your income tax and salary after tax based on a annual income.

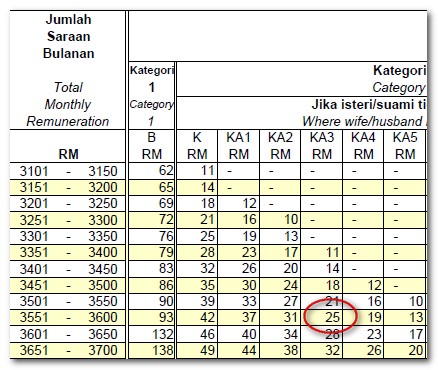

Income tax deduction malaysia calculator. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. If you need to check total tax payable for 2019 just enter your estimated 2019 yearly income into the bonus field leave salary field empty and enter whatever allowable deductions for current year to calculate the total amount of tax for current year. A simplified payroll calculator to calculate your scheduled monthly tax deduction aka potongan cukai berjadual. The acronym is popularly known for monthly tax deduction among many malaysians.

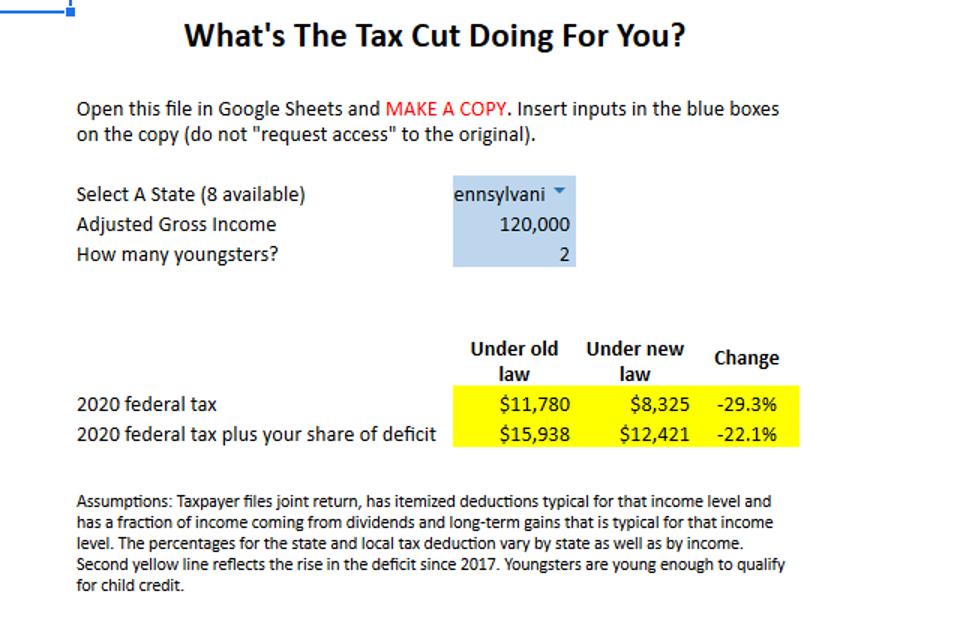

You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Review the full instructions for using the malaysia salary after tax calculators which details malaysia tax allowances and deductions that can be calculated by altering the standard and advanced malaysia tax. With a separate assessment both husband. All married couples have the option of filing individually or jointly.

About this malaysian personal income tax calculator. The calculator is designed to be used online with mobile desktop and tablet devices. When to use this calculator. Neuvoo online salary and tax calculator provides your income after tax if you work in malaysia.

This personal income tax calculator will work out tax rates obligations and projected tax returns and also tax debts for certain cases. Calculation of yearly income tax for 2019. Find your net pay for any salary. The calculator is designed to be used online with mobile desktop and tablet devices.

Simple pcb calculator is a monthly tax deduction calculator to calculate income tax required by lhdn malaysia. Once you know what your total taxable income is you want to work out the tax on that taxable income. Monthly tax deduction pcb and payroll calculator tips calculator based on malaysian income tax rates for 2019. The monthly wage calculator is updated with the latest income tax rates in malaysia for 2020 and is a great calculator for working out your income tax and salary after tax based on a monthly income.

As a general rule of thumb if both spouses are earning high incomes in the year of assessment it is always recommended to opt for separate assessment to leverage on the tax reliefs and deductibles available. Paling sesuai menggunakan ie. Review the full instructions for using the malaysia salary after tax calculators which details malaysia tax. We calculate how much your payroll will be after tax deductions in any region.

Our data is based on 2020 tax tables from malaysia.