Income Tax Act Malaysia 2019 Pdf

Charge of income tax 3 a.

Income tax act malaysia 2019 pdf. Laws of malaysia act 53 income tax act 1967 arrangement of sections part i preliminary section 1. Recovery of a company s tax and debt from directors a director who holds 20 or more of ordinary share capital in a company will be held liable for o the payment of corporate income tax. This act shall come into force on 1st july 2019. Short title and commencement 2.

2019 27 411 904. Laws of malaysia act 53 income tax act 1967 arrangement of sections part i preliminary section 1. Pursuant to section 75a 2 of the income tax act 1967 the act the meaning of a director is summarised as follows ii. This act may be cited as the finance act 2019.

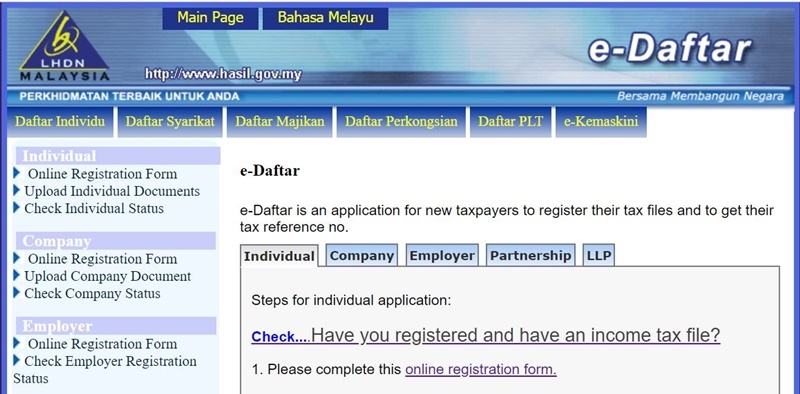

Interpretation part ii imposition and general characteristics of the tax 3. Interpretation part ii imposition and general characteristics of the tax 3. An act to amend the income tax act 1967 the real property gains tax act 1976 the stamp act 1949 the petroleum income tax act 1967 the sales tax act 2018 the finance act 2010 and the finance act 2018. Headquarters of inland revenue board of malaysia menara hasil persiaran rimba permai cyber 8 63000.

Personal income tax rates it is proposed that with effect from year of assessment ya 2020 a new chargeable income. Enacted by the parliament of malaysia as follows. The income tax act in this act referred to as the principal act is amended in section 2 by a inserting immediately after paragraph e the following ea beneficial owner means a natural person who owns. Charge of income tax 3 a.

2018 2019 malaysian tax booklet income tax. This article highlights the key amendments to tax legislation set out in the finance bill 2019. Restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research. Real property means any land situated in malaysia and any interest option or other right in or over such land.

Non chargeability to tax in respect of offshore business activity 3 c. Resident means resident in malaysia for the purposes of the income tax act 1967 except that references to basis year or basis. Amendment of income tax act cap. Short title and commencement 2.

Activity tax act 1990 instead of the income tax act 1967. Non chargeability to tax in respect of offshore business activity 3 c. October 2019 the finance bill 2019 was tabled for a first reading in parliament on 15 october 2019. 3 order 2019 has been gazetted to provide tax exemption to a non resident person in respect of income derived from malaysia in relation to any payment received from any.

86 1 a of the income tax act 1967.