E Filing Due Date 2019

E submission of certificate of residence cor for withholding tax.

E filing due date 2019. The due date for furnishing of income tax returns for the taxpayers for whom the due date i e. Tips on paying taxes. Estimate potential late payment penalties thus file even if you can t pay. The internal revenue service has extended the 2019 federal income tax filing deadline three months to july 15 2020 in response to the global coronavirus pandemic sweeping the u s.

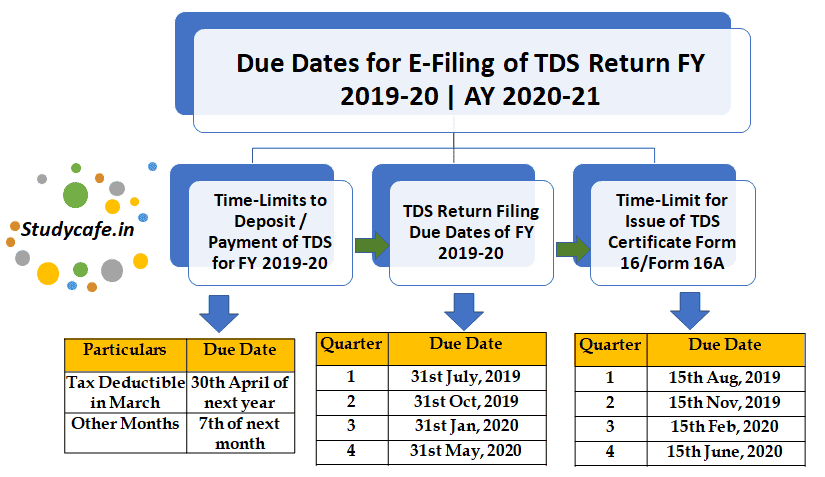

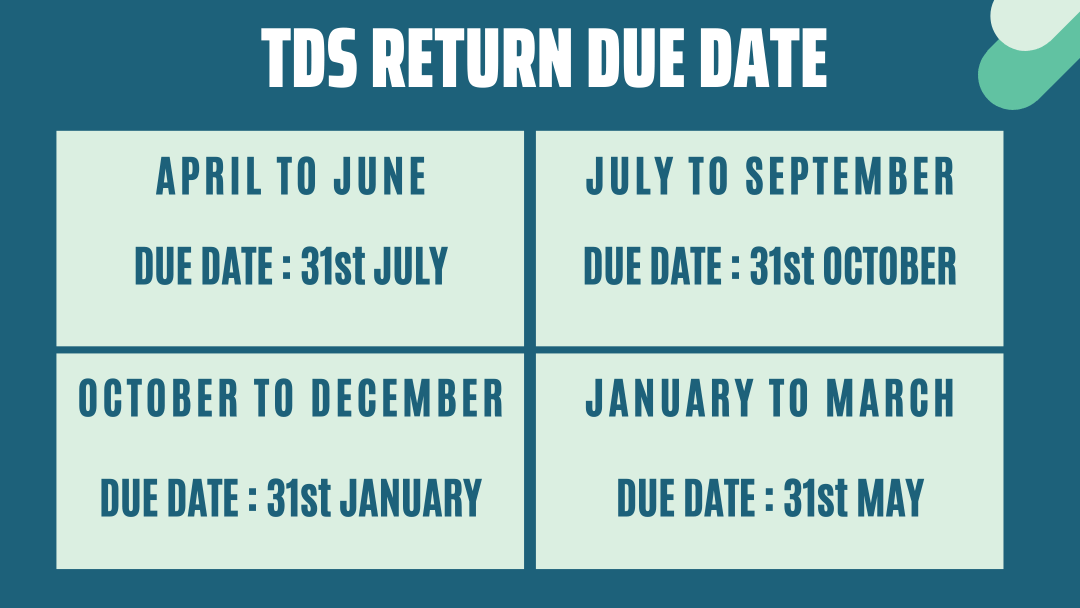

Individual income tax return on or before april 15 for your return to be considered timely if filed after april 15. Before the extension by the said notification as per the act was july 31 2020 has been extended. Find tds return due dates and tcs return due dates with the time period and last date for filing for ay 2020 21 fy 2019 20 tds stands for tax deduction at source while the tcs stands for tax collected at source. Due dates for e filing of tds tcs return fy 2019 20 ay 2020 21.

15 2020 to avoid new or additional late filing penalties. He extension from april 15 is automatic for all taxpayers who also have until july 15 to pay any taxes that would have been due on april 15. However keep in mind the following. Tds return due date for fy 2019 20 tds payment due date for fy 2019 20 tds payment due dates tds return filing due date for fy 2019 20 how to pay penalty for late filing of tds return online tcs return due date for fy 2019 20.

As per the income tax act if any person makes a payment to the receiver then tds is required to be deducted at a prescribed rate and then deposited with the government. File gst return 1 jan 31. The specific cutoff date in november is announced in october in the quickalerts library. If april 15 doesn t fall on a weekend or legal holiday you must file form 4868 application for automatic extension of time to file u s.

If you e filed an extension or did not file a 2019 tax return by july 15 2020 or later and expect to owe taxes e file your 2019 tax return by oct. Due dates for filing tds returns. Form 24q form 26q form 27q and form 27eq are the same and as follows. Quarter period last date of filing 1st quarter 1st april to 30th june 31st july 2019.