Tax Law In Malaysia

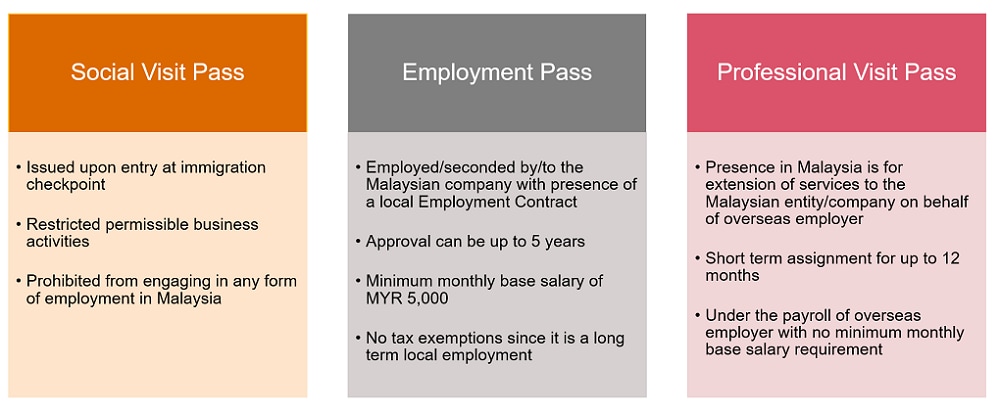

Any foreigners who have been working in malaysia for more than 182 days are eligible to be taxed under normal malaysian income tax laws and rates just like malaysian nationals.

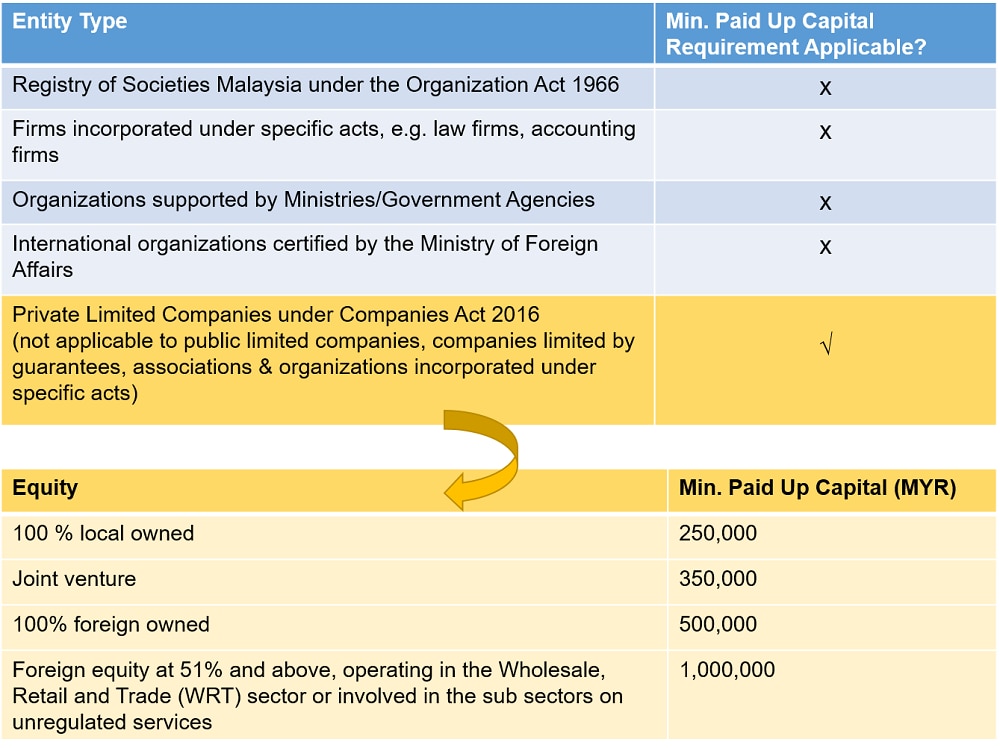

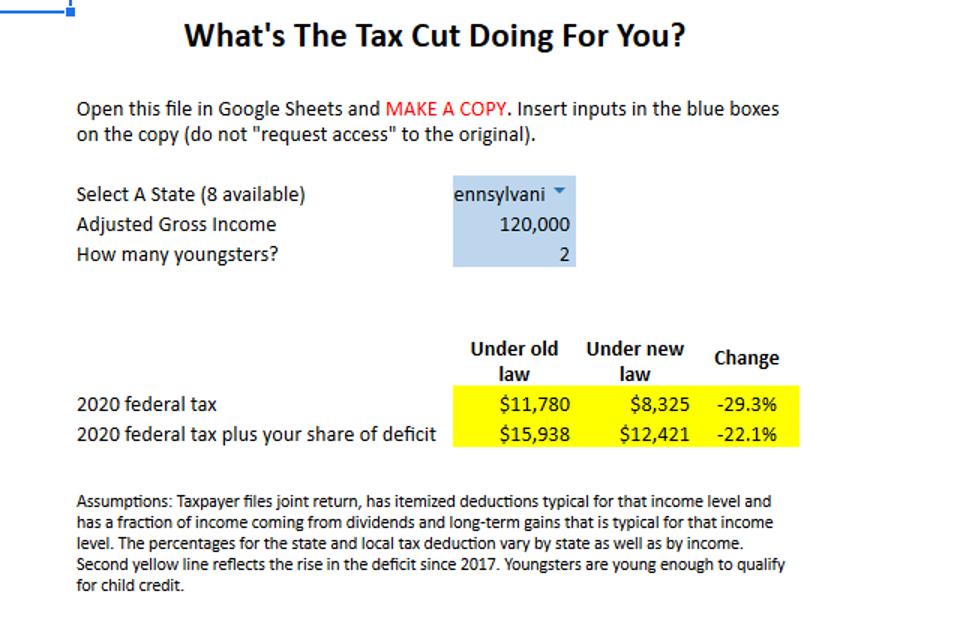

Tax law in malaysia. Short title and commencement 2. Short title and commencement 2. Personal income tax rates. Generally you are only taxed for the profit that you or your business earns.

Meaning of manufacture part ii administration 4. Corporate tax laws and regulations 2020. Non chargeability to tax in respect of offshore business activity 3 c. Taxable income myr tax on column 1 myr tax on excess over.

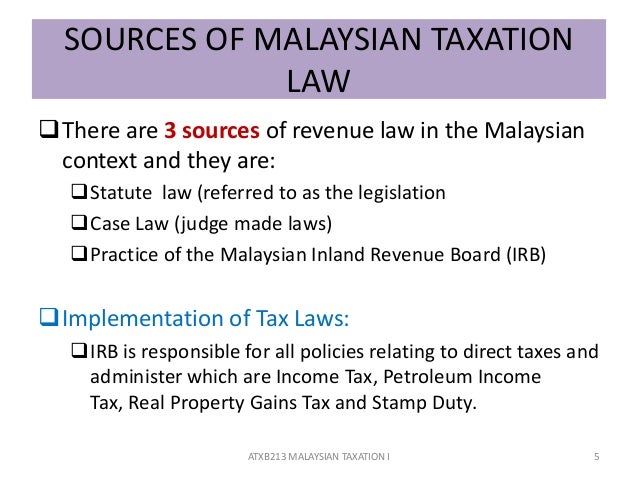

As such there s no better time for a refresher course on how to lower your chargeable income. These proposals will not become law until their enactment and may be amended in the course of their passage through. Inland revenue in respect of the particular tax law and the policy and proced ure that are to be applied. According to lhdn foreigners employed in malaysia must give notice of their chargeability to the non resident branch or nearest lhdn branch within 2 months of their arrival in malaysia.

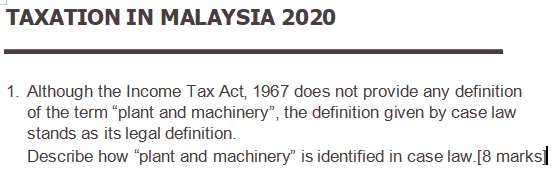

Charge of income tax 3 a. The following rates are applicable to resident individual taxpayers for ya 2020. Section 33 1 of the income tax act 1967 ita reads as follows. Laws of malaysia act 53 income tax act 1967 arrangement of sections part i preliminary section 1.

Director general of inland revenue inland revenue board malaysia. Sales tax 3 laws of malaysia act 806 sales tax act 2018 arrangement of sections part i preliminary section 1. This booklet also incorporates in coloured italics the 2020 malaysian budget proposals announced on 11 october 2019 and the finance bill 2019. Iclg corporate tax laws and regulations malaysia covers common issues in corporate tax laws and regulations including capital gain overseas profits real estate anti avoidance beps and the digital economy in 33 jurisdictions.

Interpretation part ii imposition and general characteristics of the tax 3. Persons appointed or employed to be public servants 6. Functions and powers of director general and other officers 5. Tax deductions in malaysia are available in numerous cases including medical expenses purchase of books computers and sport equipment or education fees.

An individual whether tax resident or non resident in malaysia is taxed on any income accruing in or derived from malaysia. This publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practices. The inland revenue board of malaysia which is the country s responsible institute for taxation provides very clearly represented and detailed information on all tax issues. Expatriates working in malaysia for more than 60 days but less than 182 days are considered non tax residents and are subject to a tax rate of 30 percent.