Mpers Property Plant And Equipment

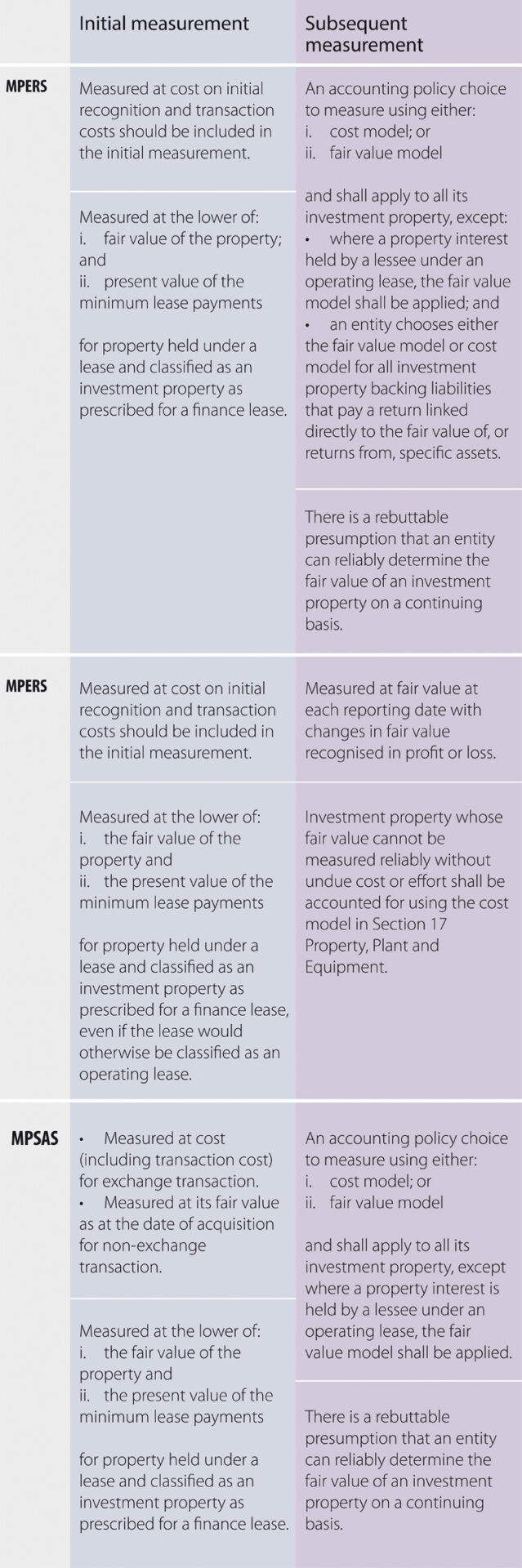

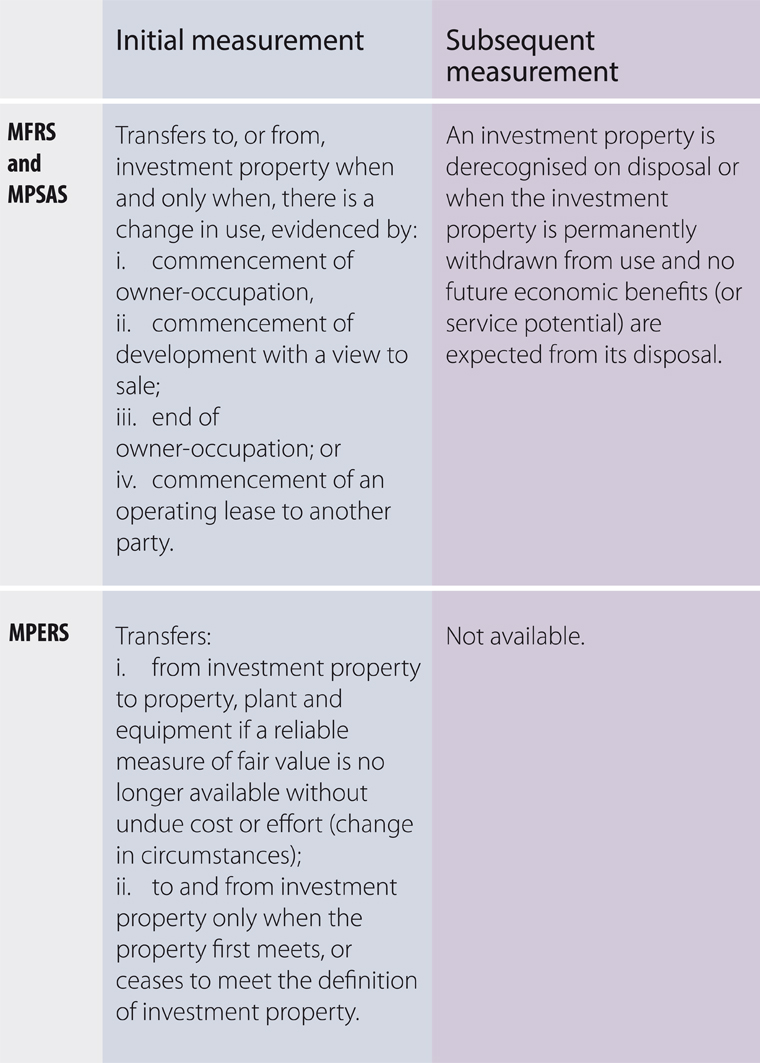

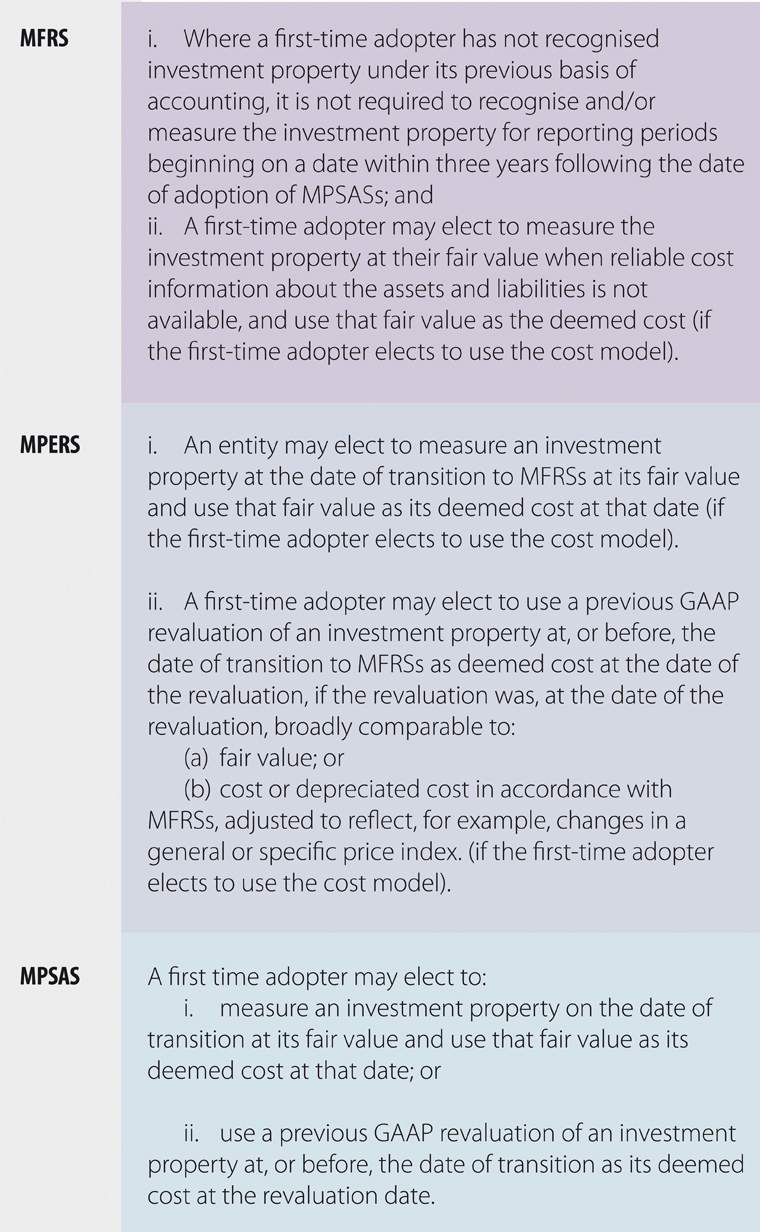

A first time adopter may elect to measure an item of property plant and equipment an investment property or an intangible asset on the date of transition to mpers at its fair value and use that fair value as its deemed cost at that date in accordance with paragraph 35 10 c.

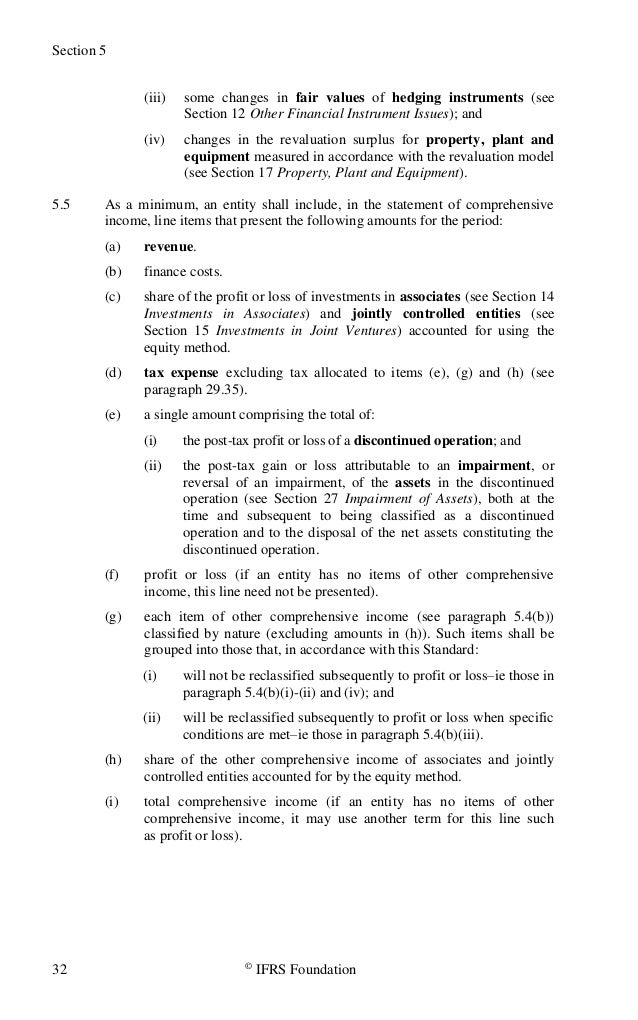

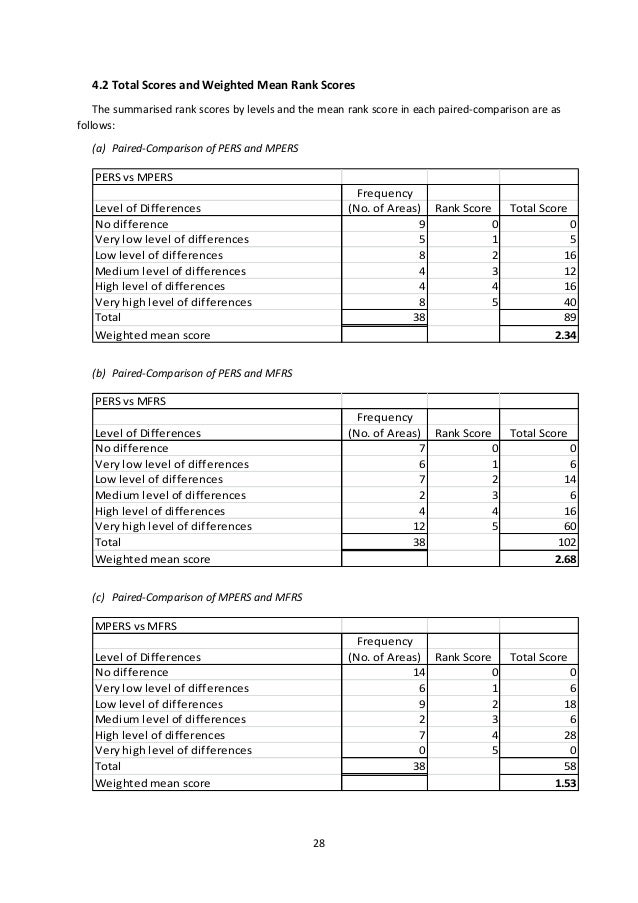

Mpers property plant and equipment. Mpsas 17 property plant and equipment 5 7. Mfrs 116 property plant and equipment mfrs 116 are tangible asset that are held for use in the production or supply of goods or services for rental to others for administritive purposes and are expected to be used during more than one period. The 2015 amendments to the ifrs for smes has now allowed an option to use the revaluation model for property plant and equipment ppe in applying section 17 property plant and equipment. Recognition of property plant and equipment 11.

However mfrs 116 is not applicable to the following such as ppe classified as held for sale ifrs 5 investment properties accounted for using. For example mpsas 13 leases requires an entity to evaluate its recognition of an item of leased property plant and equipment. Applies two recognition principles one on initial recognition and the other on subsequent expenditure enhancement principle to account for ppe masb 16 18 16 27. Property plant and equipment.

P9 the mpers is based on the iasb s international financial reporting. During the year ended 31 december 2017 the company adopted the revaluation model for its administrative building. Initial measurement is at cost masb 16 18. 17 property plant and equipment 99 18 intangible assets other than goodwill 107.

The administrative building is revalued to its fair value at the end of every second year. And aligning the main recognition and measurement requirements for income taxes with ifrs. Financial year 2016 for the effects of measuring the property plant and equipment at its deemed cost. And b the cost of the asset to the enterprise can be measured reliably.

A it is probable that future economic benefits associated with the asset will flow to the enterprise. Property plant equipment ppe masb 16. Property plant and equipment. An item of property plant and equipment should be recognised as an asset when.

Specifically the iasb said it would. The cost and accumulated depreciation accounts are restated proportionately with every revaluation. For property development activities based on frs 201 property development activities. When the ifrs for smes was issued in 2009 the iasb stated that it planned to undertake an initial comprehensive review of the standard after two years of use by smes.

Other mpsass may require recognition of an item of property plant and equipment based on an approach different from that in this standard.