Islamic Banking Products In Malaysia

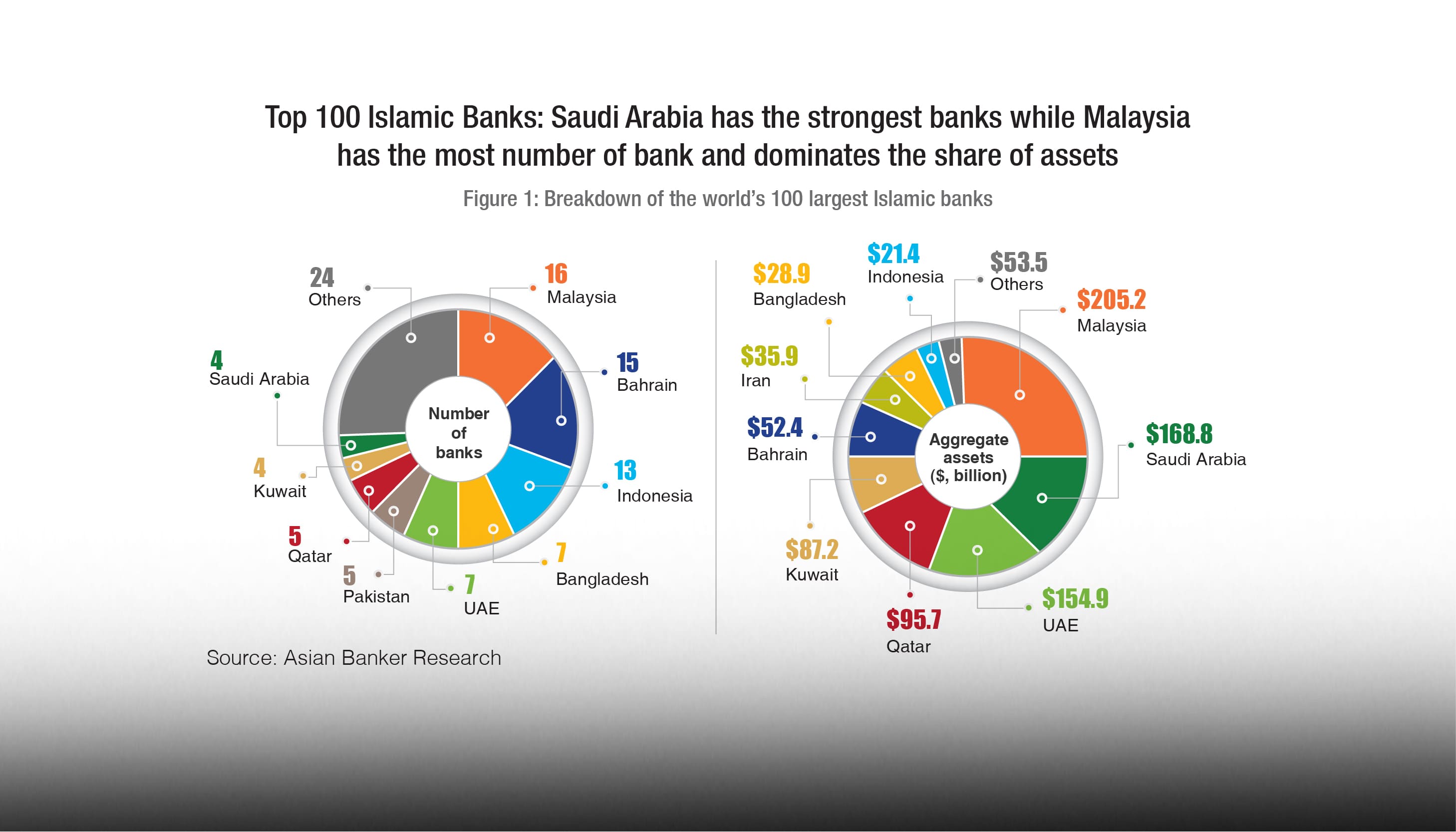

With the introduction of value based intermediation vbi by bank negara malaysia bnm in 2017 the association of islamic banking and financial institutions malaysia aibim is confident the central bank s target for the local islamic banking industry to have 40 market share in total banking assets by 2020 is achievable.

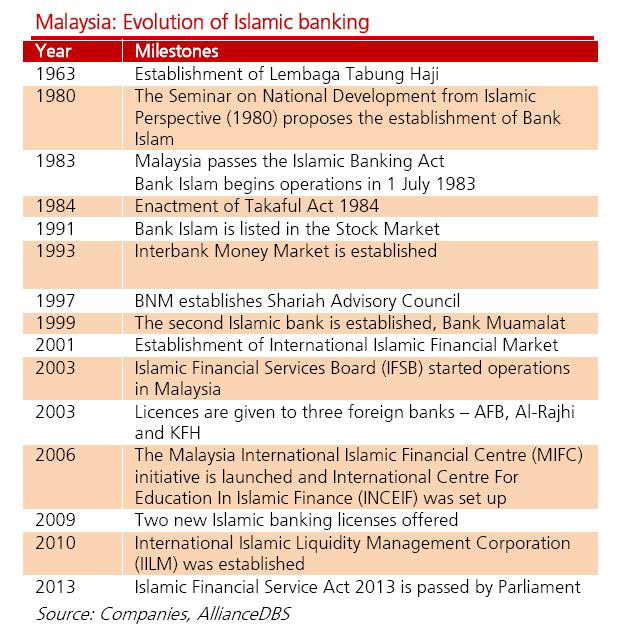

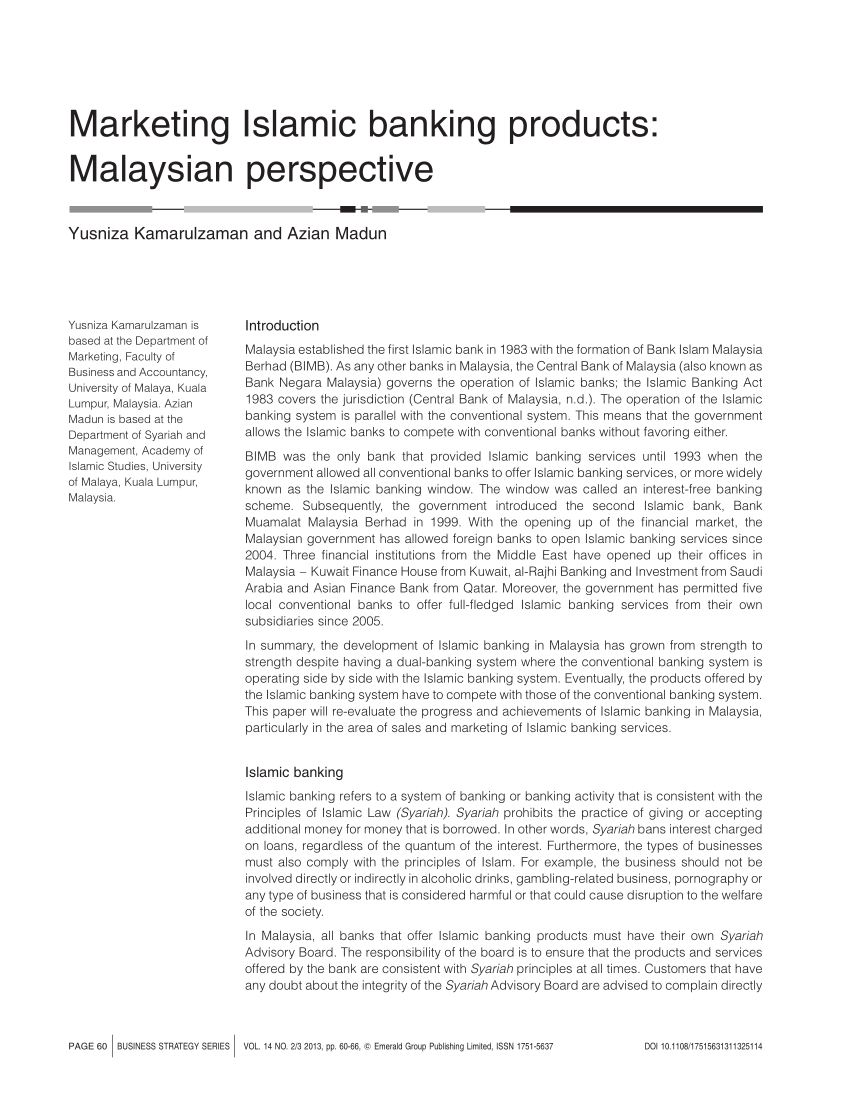

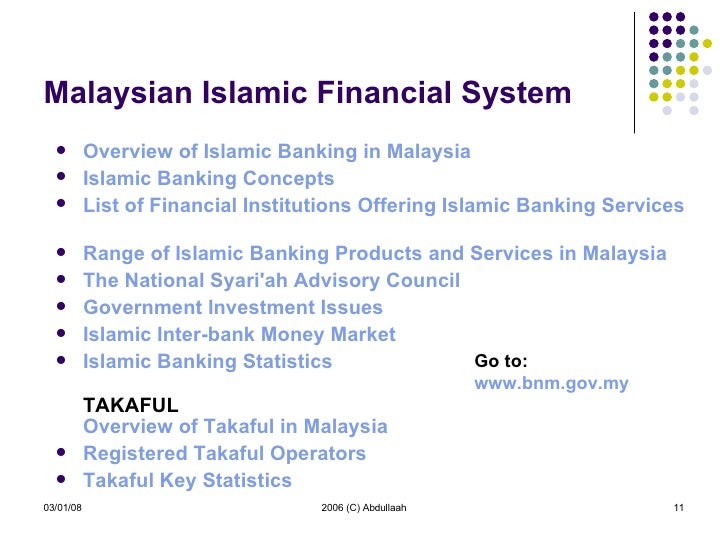

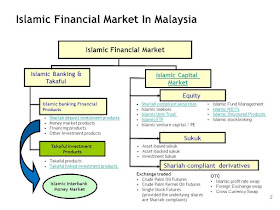

Islamic banking products in malaysia. For example current accounts and savings accounts are under wadiah yad dhamanah deposits with guarantee mudharabah profit sharing and qard interest free loan. Continuously evolve in line with market changes. Islamic banking in malaysia began in september 1963 when perbadanan wang simpanan bakal bakal haji pwsbh was established. Ambank islamic s comprehensive range of shariah compliant retail and non retail banking products and services including investment treasury and trade solutions and delivery channels.

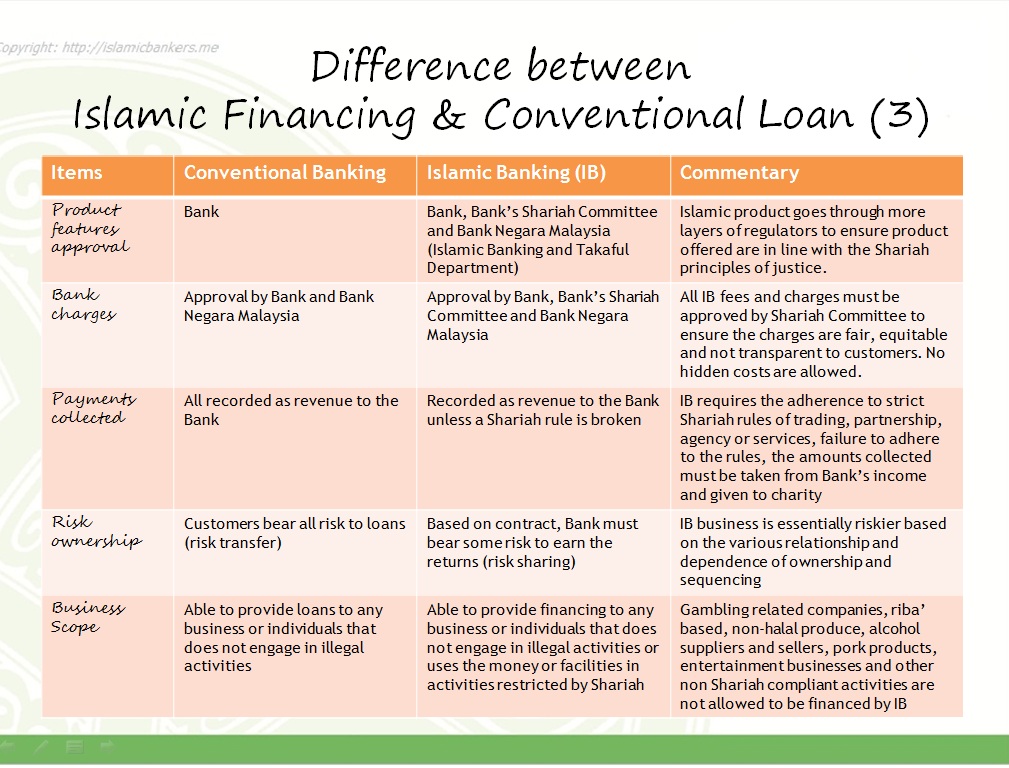

However some distinct differences can be observed. Mohammed waseem april 7 2014 islamic banking products part 3 murabahah 2014 04 07t14 53 42 00 00 islamic banking products 2 comments by mohammed waseem murabahah is another product based on the islamic sharee ah. Kuala lumpur sept 25. Pwsbh was set up as an institution for muslims to save for their hajj pilgrimage to mecca expenses.

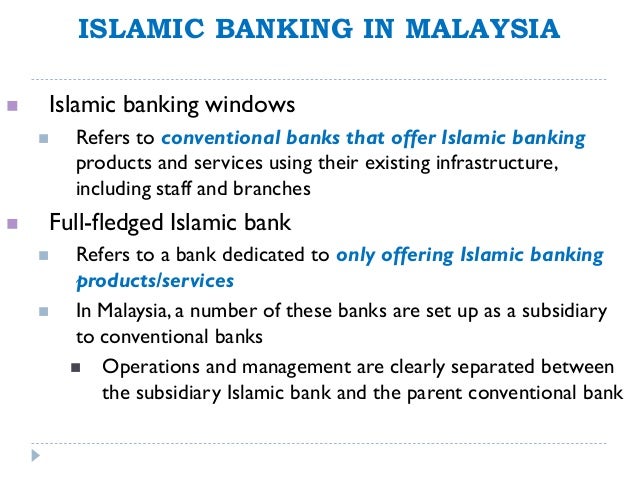

Products are developed for the entire market regardless of the consumers religious beliefs. The islamic banking industry in malaysia has advanced significantly over the years. Banks in that country offering islamic credit cards as of sometime after 2012 include bank islam malaysia berhad cimb islamic bank berhad hsbc amanah malaysia berhad maybank islamic berhad rhb islamic bank berhad standard chartered berhad am islamic bank berhad. Enjoy a range of products that allows you to bank the islamic way.

The approach of islamic banks in malaysia is similar. Malaysia s islamic finance sector is ingrained in the domestic financial market with islamic financing and bonds accounting for 32 and 60 respectively of domestic banking system loans and outstanding bond issuances at end 2018. In 1969 pwsbh merged with pejabat urusan haji to form lembaga urusan dan tabung haji now known as lembaga tabung haji. Depositors are guaranteed repayment of the whole amount of deposits and have no right to receive any return from islamic banks.

Islamic banks also offer a wide range of competitive and innovative products complementing solutions offered by conventional banks. Islamic banking services are very similar to those in conventional banks. An example of this is takaful insurance products where the benefits of hibah gift and the principle of surplus sharing are attractive to all.