Income Tax Relief 2018 Malaysia

To help make things a little clearer we run through the list of all items eligible for tax relief with explanations for some of the more confusing entries.

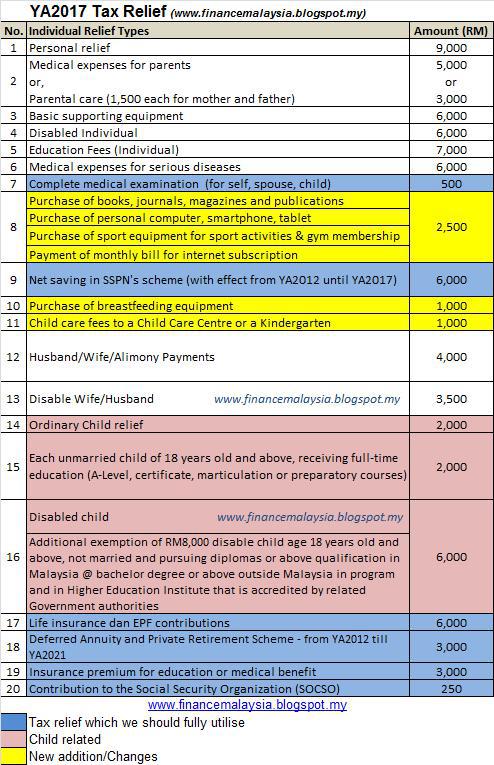

Income tax relief 2018 malaysia. Personal tax reliefs in malaysia. Net saving in sspn s scheme total deposit in year 2018 minus total withdrawal in year 2018 rm6 000. Medical expenses for parents. Special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually.

For income tax malaysia tax reliefs can help reduce your chargeable income and thus your taxes. If planned properly you can save a significant amount of taxes. You can refer to the table of lists of the income tax relief 2018 malaysia. I 5 000 limited year of assessment.

2018 budget chargeable date deadline e filing earn exemptions file income income tax inland irbm lhdn malaysia pay revenue season tax just in news 4 hours ago. The conditions of entitlement for each relief must be satisfied in order to minimize the income tax liability. For income tax malaysia tax reliefs can help reduce your chargeable income and thus your taxes. This relief is applicable for year assessment 2013 and 2015 only.

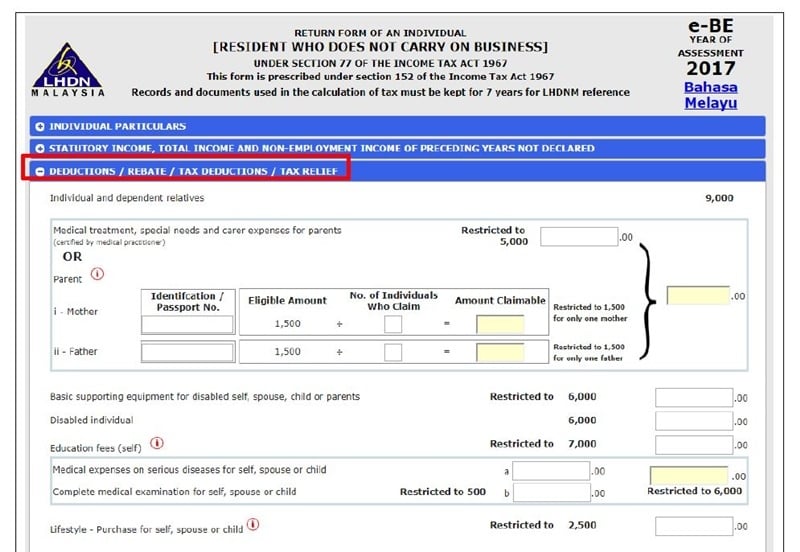

This guide is for assessment year 2017 please visit our updated income tax guide for assessment year 2019. Reliefs are available to an individual who is a tax resident in malaysia in that particular ya to reduce the chargeable income and tax liability. Reduction of the income tax rate from 18 to 17 on the first myr 500 000 of chargeable income of small and medium sized enterprises i e. Tax filing season has begun in malaysia and the task of trying to save money through claiming tax relief and rebates can be confusing.

As the clock ticks for personal income tax deadline in malaysia 2018 like gainfully employed malaysians you may have started visiting the lhdn malaysia website to do your e filing as both a proactive and precautionary measure. The malaysian government in its budget 2018 announced numerous tax changes including an income tax cut incentives for women to return to work and tax relief for property investors and venture capital firms. Basic supporting equipment. Child care fees to a child care centre or a kindergarten.

If you didn t make the most out of the lifestyle income tax relief before now is the time to do it. If planned properly. Insurance other policies. 5 000 limited 3.