Income Tax Act Malaysia Pdf

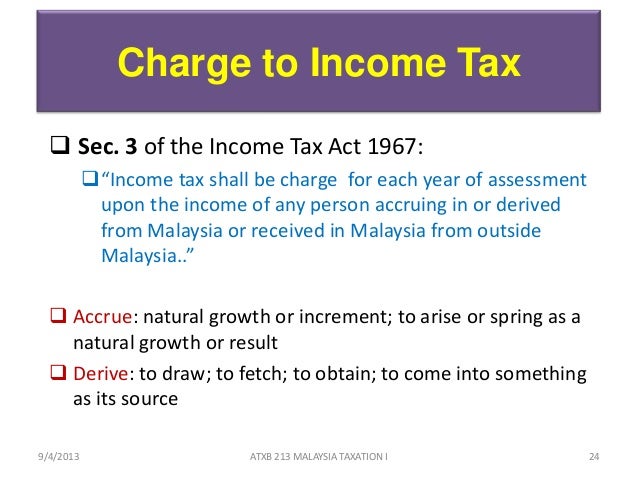

Interpretation part ii imposition and general characteristics of the tax 3.

Income tax act malaysia pdf. Enacted by the parliament of malaysia as follows. Laws of malaysia act 53 income tax act 1967 arrangement of sections part i preliminary section 1. 1 this act may be cited as the petroleum income tax act 1967. 3 this act shall have effect for the year of assessment 1968 and subsequent years of assessment.

Laws of malaysia reprint published by the commissioner of law revision malaysia under the authority of the revision of laws act 1968 in collaboration with malayan law journal sdn bhd and percetakan nasional malaysia bhd 2006 act 53 income tax act 1967 incorporating all amendments up to 1 january 2006 053e fm page 1 thursday april 6 2006 12. Malaysia taxation and investment 2018. Short title and commencement 2. This act may be cited as the finance act 2018.

Non chargeability to tax in respect of offshore business activity 3 c. Laws of malaysia act 53 income tax act 1967 arrangement of sections part i preliminary section 1. 150 tarikh kemaskini. An act to amend the income tax act 1967 promotion of investments act 1986 stamp act 1949 real property gains tax act 1976 labuan business activity tax act 1990 service tax act 2018 and sales tax act 2018.

Intellectual property corporation of malaysia act 2002 the geographical indications act 2000 the. Income tax prescribed fees under schedule 5 to the act rules 1998 income tax deductions for promotion of export of services rules 1999 income tax deduction for freight charges from sabah or sarawak to peninsular malaysia rules 2000 income tax deduction for corporate debt restructuring expenditure rules 2000. Non chargeability to tax in respect of offshore business activity 3 c. Status the principal hub incentive grants a full tax exemption on value added income for a period of five years.

Income tax leasing regulations 1986 1 income tax leasing regulations 1986 pu a 131. 2 this act shall extend throughout malaysia. Income tax construction contracts regulations 2007 5 6 4 where the estimated gross profit or revised estimated gross profit of a construction. Short title and commencement 2.

A labuan entity can make an irrevocable election to be taxed under the income tax act 1967 in respect of its labuan business activity. Chapter i preliminary short title 1. Charge of income tax 3 a. Interpretation part ii imposition and general characteristics of the tax 3.

Income tax act 1967 regulations. 1 in this act unless the context otherwise requires. Activity tax act 1990 instead of the income tax act 1967.