Income Tax Act Malaysia Capital Allowance

Pursuant to the income tax accelerated capital allowance automation equipment rules 2017 p u.

Income tax act malaysia capital allowance. The value of the asset is increased from rm1 300 to rm2 000 and the total capital allowances capped is increased from rm13 000 to rm20 000 w e f. Income tax accelerated capital allowance security control equipment. The rules allow for ca to be fully claimed on the development cost of customised software over four years by a resident person in malaysia based on an initial allowance of 20 and annual allowances of 20. Headquarters of inland revenue board of malaysia menara hasil persiaran rimba permai cyber 8 63000.

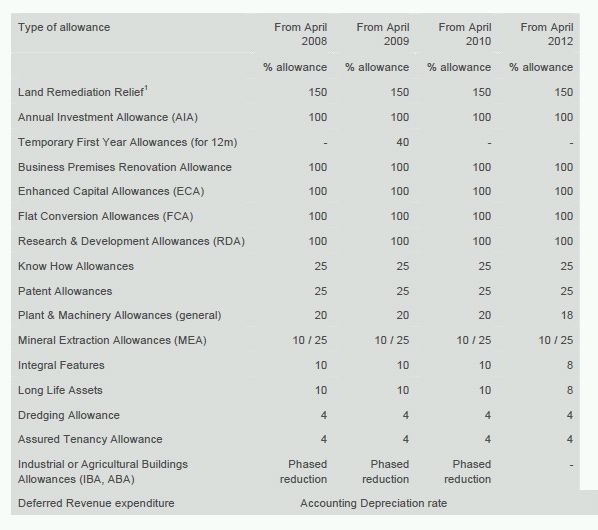

However schedule 3 of the income tax act 1967 has laid down several allowable deductions in the form of allowances for the capital expenditures that have been incurred. The total capital allowances of such assets are capped at rm20 000 except for smes as defined. However schedule 3 of the income tax act 1967 has laid down several allowable deductions in the form of allowances for the capital expenditures that have been incurred. 15 april 2013 page 2 of 34 2 14.

Capital allowance is only given to business activity. 2 2 the provisions of the income tax act 1967 ita related to this pr are. The purpose of claiming capital allowances. Inland revenue board of malaysia date of issue accelerate capital allowance public ruling no.

Restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research. A 252 and income tax exemption no. Laws of malaysia act 53 income tax act 1967 arrangement of sections part i preliminary section 1. Small value assets not exceeding rm2 000 each are eligible for 100 capital allowances.

Interpretation part ii imposition and general characteristics of the tax 3. Income tax capital allowances and charges rules 1969 1 income tax capital allowances and charges rules 1969 pu a 96 20 february 1969 in exercise of the powers conferred upon him by section 154 1 b of the income tax act 1967 the minister of finance hereby makes the following rules. 8 order 2017 p u a 253 a manufacturing company is eligible for automation capital allowance automation ca on amounts incurred for the purchase of automation equipment as follows see tax alert no. Charge of income tax 3 a.

Short title commencement and interpretation. The income tax capital allowance development cost for customised computer software rules 2019 the rules have been gazetted on 3 october 2019. Capital allowances consist of an initial allowance and annual allowance. Relevant provisions of the law 2 1 this pr takes into account laws which are in force as at the date this pr is published.

.jpg)

.jpg)