Financial Inclusion In Malaysia

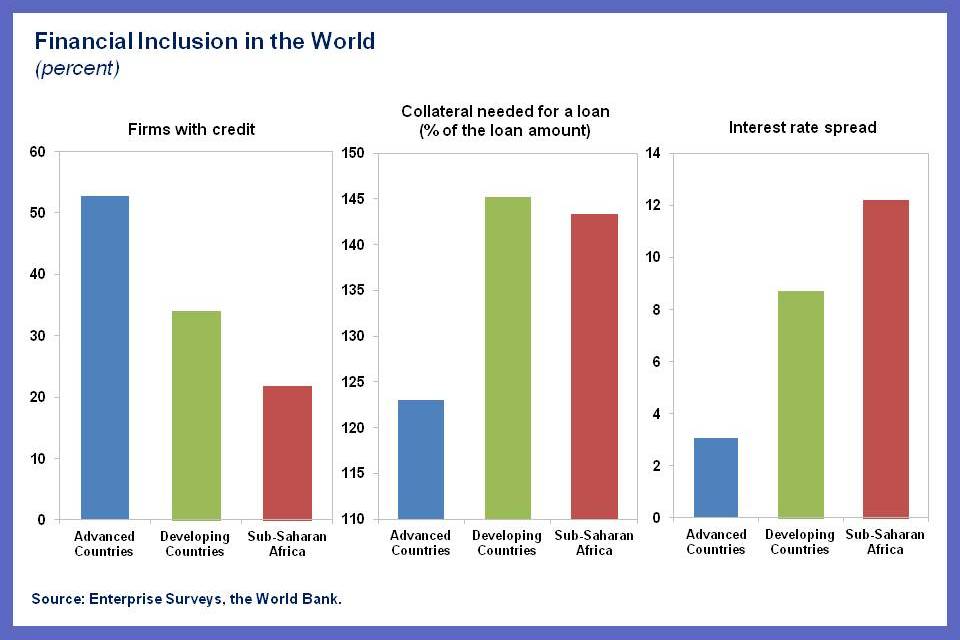

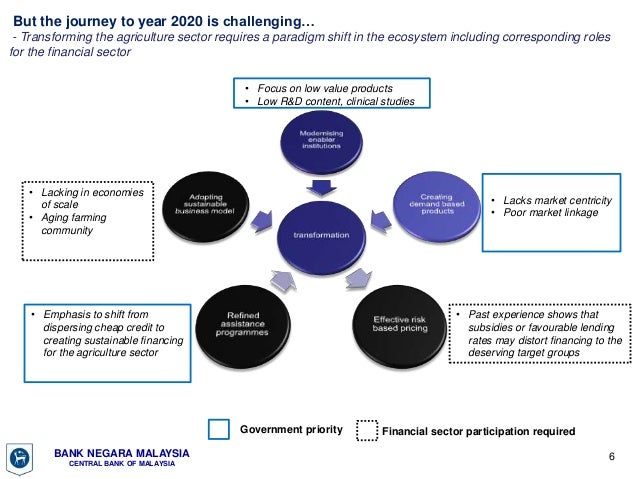

Financial inclusion is an important thrust in the bank s developmental role to ensure that every economic activity geographical region and segment of society have access to financial services.

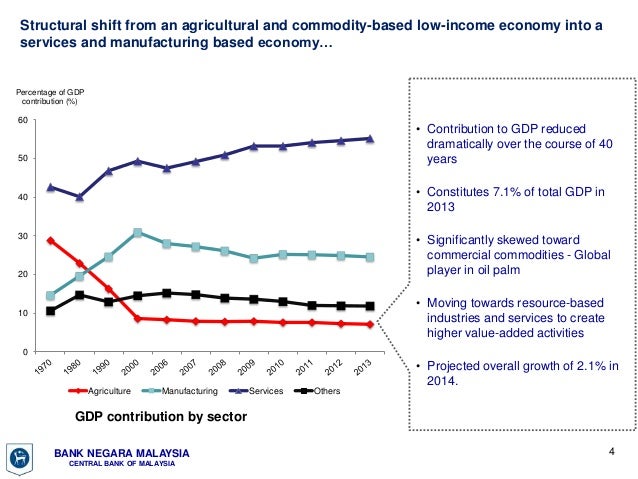

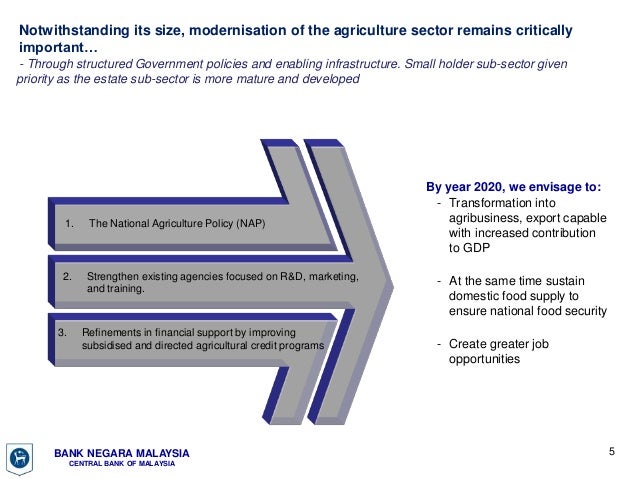

Financial inclusion in malaysia. To date malaysia s bond market is the third largest in asia after japan and korea. Given malaysia s success in the development of islamic finance these lessons will be useful to policy makers and regulators in other islamic finance jurisdictions as they make efforts to enhance islamic financial. Section 2 provides the background of the state of financial inclusion in malaysia followed by the development of the financial inclusion index in section 3. The main purpose of this report is to explore the role islamic finance has played in furthering financial inclusion in malaysia with a view to drawing key lessons of experience.

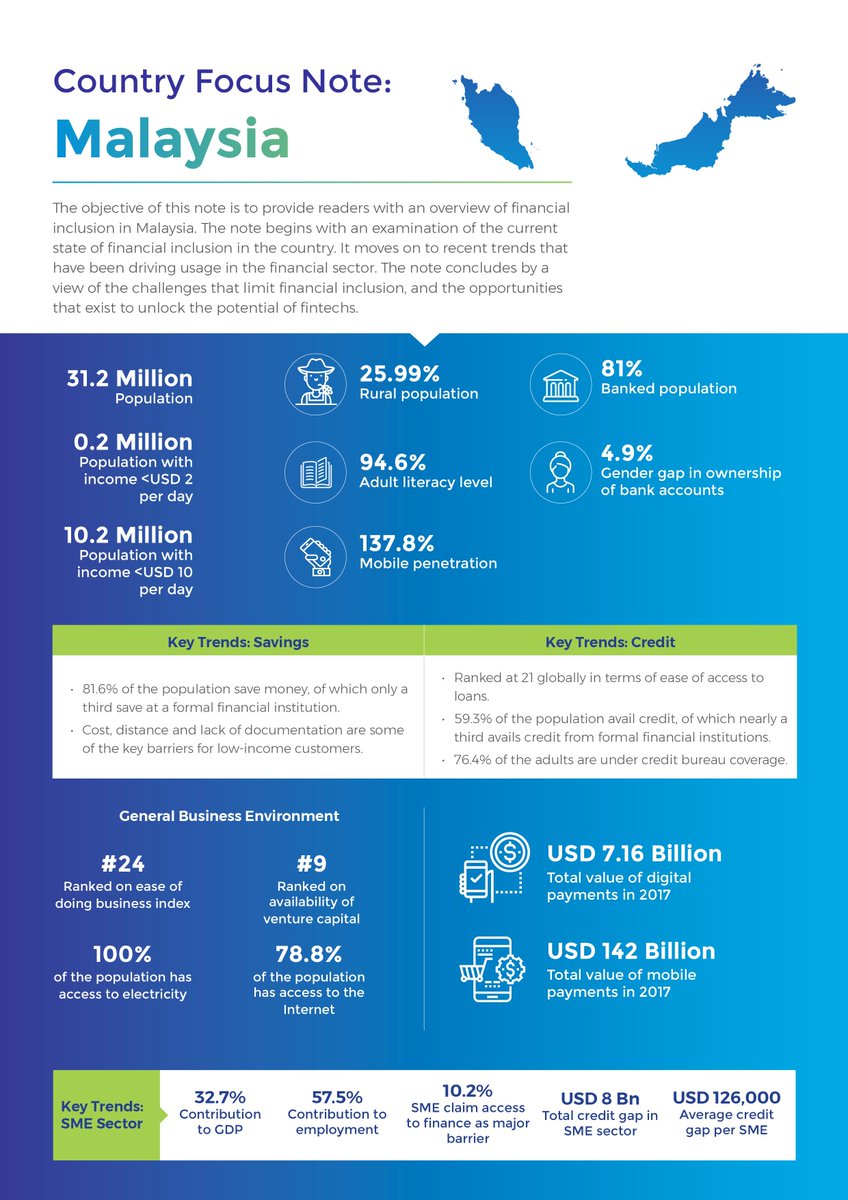

Financial inclusion in malaysia june 8 2017 malaysia has achieved one of the highest levels of financial inclusion among southeast asia countries due in part to policies taking advantage of mobile phones and banking agents to expand access. Malaysia faces two main challenges in terms of financial inclusion. Secondly a major challenge is how to ensure that the people with access to financial services actually make active use of their accounts. Recognising the importance of measurements in translating policies into real impact bank negara malaysia also adopted the sasana accord during the afi global policy forum 2013 in kuala lumpur and developed a set of key performance indicators and a financial inclusion index to track the progress and estimate the impact of policies in order to intensify the outreach of the financial products.

First malaysia will need to reach out to the remaining under served population. Skip to main content explore. A research paper on financial inclusion in malaysia. Financial inclusion in malaysia.

2011 and a financial inclusion index developed in 2012. Given this background the major objective of the study is to measure the extent of financial inclusion in malaysia. Distilling lessons for other countries was prepared by a team of the finance and markets global practice of the world bank group consisting of jose de luna martinez task team leader and sergio campillo diaz.