E Filing Due Date 2020

The interest rate for a delay in the deposit of tds has also been reduced from 18 to 9.

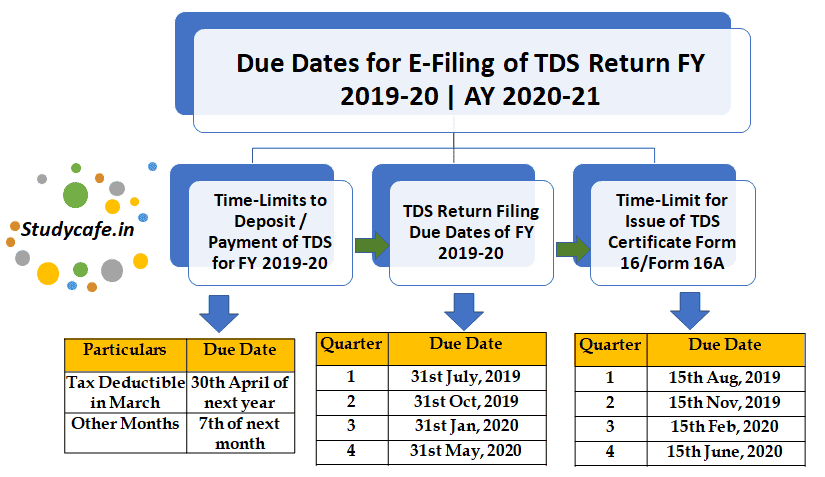

E filing due date 2020. The due date for march 2020 tds deposit is 30th april 2020 however due date for government deductors paying through challan for march 2020 is 7th april 2020. File estimated chargeable income eci dec year end 31 mar 2020. October 15 2020 is e file deadline for 2019 tax returns. E submission of certificate of residence cor for withholding tax.

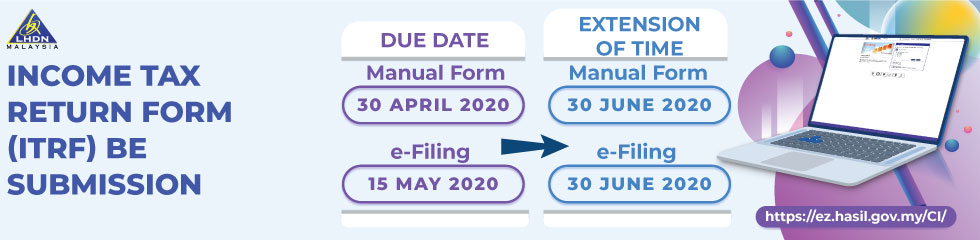

Important update as form dpt 3 is included in the list of forms under the companies fresh start scheme cfss 2020 one can file e form dpt 3 till 31st december 2020 without any late filing fees. Those individuals can do it by 30 september 2020. According to the latest update of the electronically filed itr verification due date. Jika pembayar cukai mengemukakan borang e be tahun taksiran 2019 pada 1 julai 2020 bn tersebut akan dianggap sebagai lewat diterima mulai 1 mei 2020 dan boleh dikenakan penalti di bawah subseksyen 112 3 acp 1967.

The returns of income which are required to be filed by 31st july 2020 and 31st. The government has extended the last date to file it returns for the financial year 2018 2019 to 30 june 2020. The due dates for filing of itr for different categories of taxpayers for the financial year 2019 20 are listed in the table below. The due date for gstr 1 for the month of march 2020 is 30th june 2020.

1st april to 30th june and therefore due date for issuing form 16 for fy 19 20 would be 15th june 2020. 04 april 2020 government provides the reasons behind tds like move on remittances. Form 16a should be issued within 15 days from the due date for furnishing the statement of tax deducted at source. Form 16 is issued for cumulative period i e.

Interest on late payment of tds. E submission of employment income. File gst return 1 jan 31. Tambahan masa diberikan sehingga 30 jun 2020 bagi pengemukaan secara e filing pos atau serahan tangan.