Difference Between Sst And Gst Malaysia

Malaysia s gst vs sst knowing the difference.

Difference between sst and gst malaysia. We are going to outline these differences to help you learn more about these two types of taxation systems. Pricewaterhousecoopers taxation services malaysia pwc executive director and head of indirect tax raja kumaran. Compared to the gst tax system sst is way less efficient and provide much progress in terms of tax collection. The differences between sst gst.

The service tax was governed by the service tax act 1975 and this was also a federal consumption tax. As mentioned earlier the gst was introduced in april 1 st 2015 with the goal to implement tax on various consumable services and bring wide range of products under value added services. Getting to know the difference between sst and gst. Difference between sst and gst.

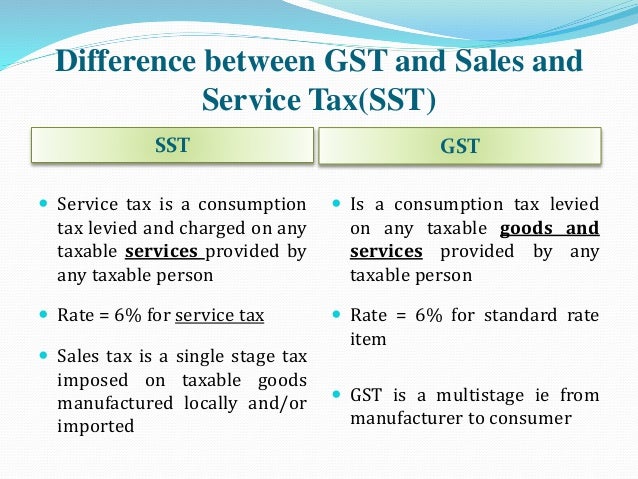

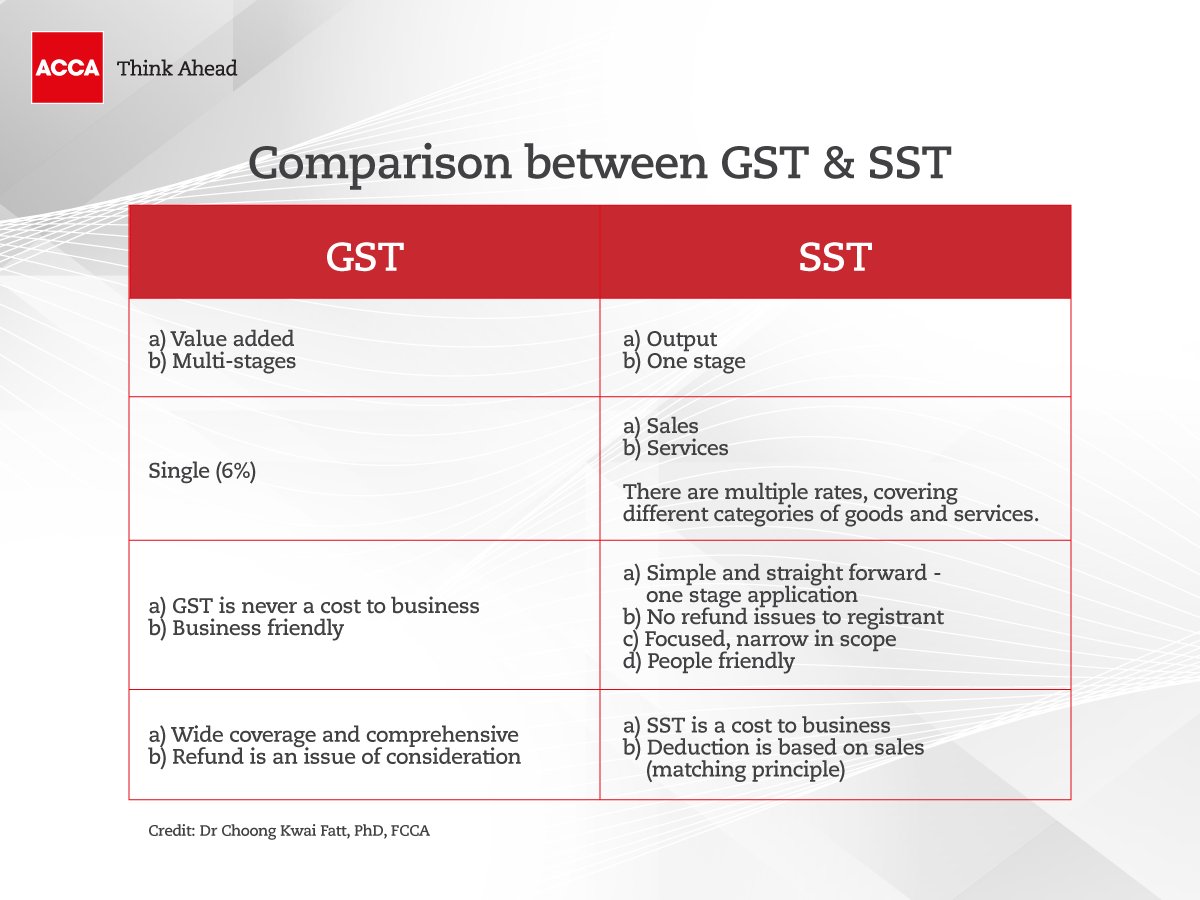

To put it simply the sst consists of two separate taxes that are governed by two distinct tax laws on goods and services at a single stage. Know what s happening understand the fears and be prepared for the change from gst to sst which the 1st stage of implementation happening with zero rated gst this june 2018. Malaysia s decision to revert to the sales and service tax sst from the goods and services tax gst will result in a higher disposable income due to relatively lower prices it will incur in. By mypf economy government infographic spending tax your malaysian gst to sst guide.

There has been plenty of talks recently in relation to the goods and services tax gst. Before the sst is officially implemented take time to enjoy the honeymoon period of spending money in malaysia. It is sales tax and service tax which are two separate taxes. These are not new taxes and had in fact existed in malaysia since the 1970s and were only removed in 2015 when the gst was introduced.

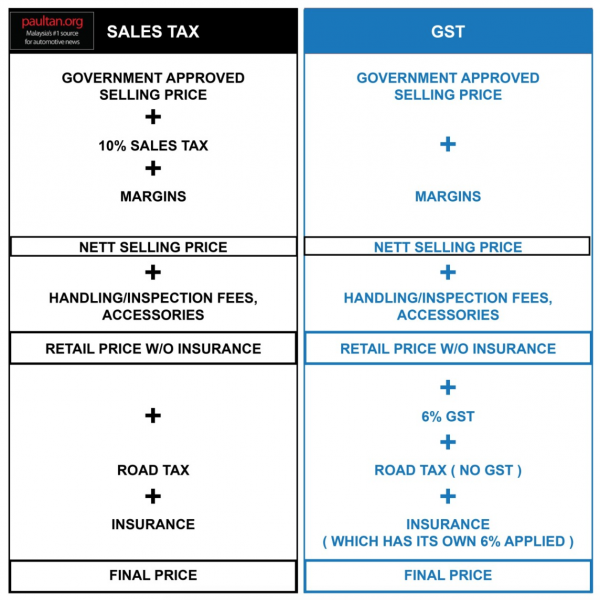

The sales and services tax sst was recently reintroduced back in malaysia as part of pakatan harapan s post election victory manifesto during ge 18. The key difference is that the sst is a single staged taxation system usually either at the consumer level or the manufacturer level while gst is multi staged with a system of rebate for those in the intermediate stage. The example below makes certain assumptions for simplification purposes just to show the differences between sst gst. There are a few differences between sst and gst which you need to know about.

Gst vs sst in malaysia.